Week 41: Reality (Singularity), Strikes Back

Dear all,

Think big. Now try to think even bigger. Exponential, not linear.

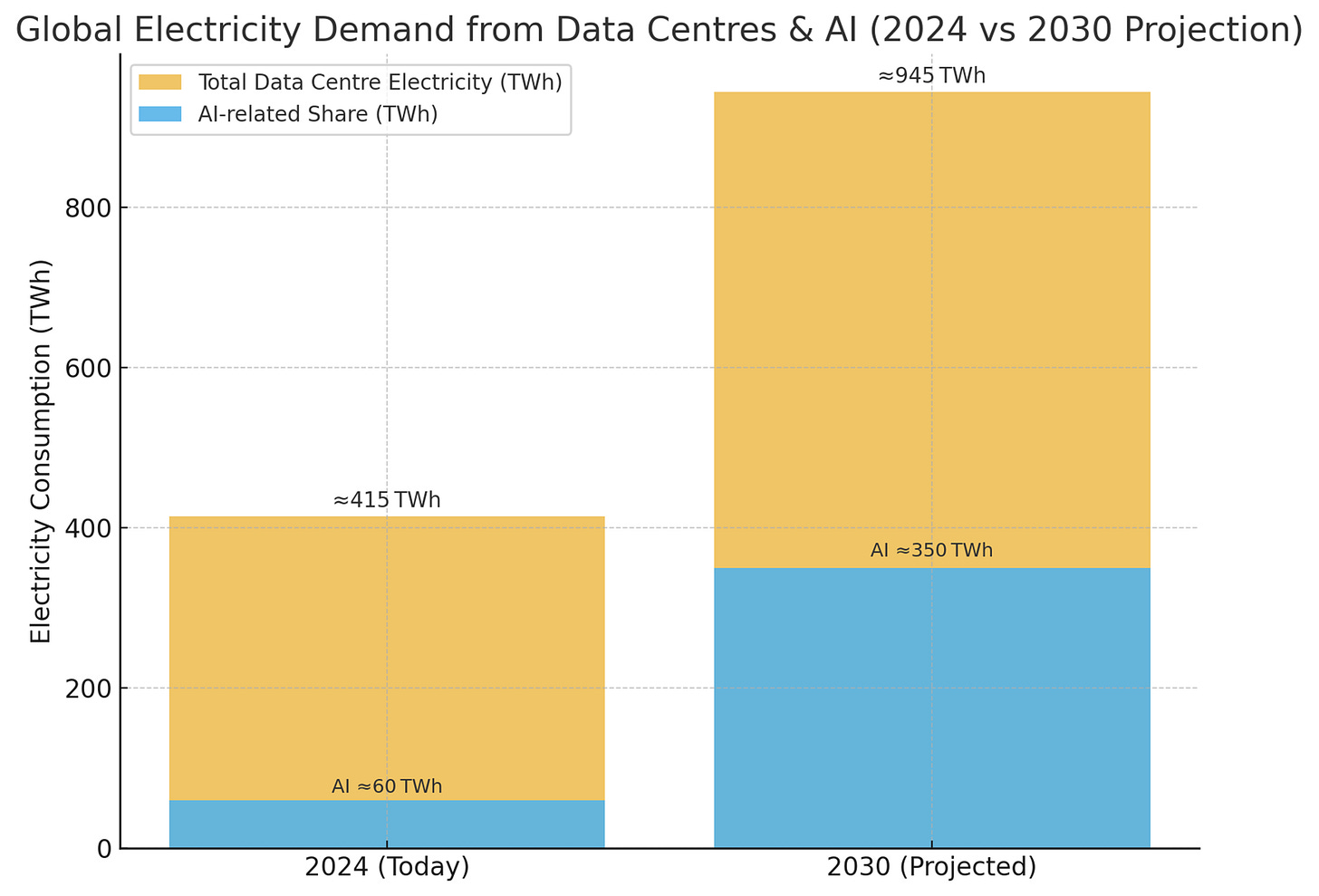

It’s hard to imagine — the scale, the time, the speed, the impact. The longer you contemplate this graph, the more dangerous it looks.

How will we do this? Nuclear? Fossil? Renewable? All of it — more of everything.

To meet the projected increase in global energy demand driven by artificial intelligence — particularly the anticipated additional requirement of around 1,000 terawatt-hours (TWh) by 2030 — we can look at nuclear power as a potential solution.

Current nuclear power plants have an average capacity of about 1 gigawatt (GW) and, depending on their capacity factor, typically produce around 7 to 9 TWh of electricity annually. We would need to build approximately 125 new nuclear power plants by 2030 to meet the additional energy requirements driven by AI advancements alone.

There are currently about 440 operational nuclear reactors worldwide, contributing roughly 10% of global electricity. Building 125 new nuclear power plants by 2030 does not sound very realistic, given that it takes at least 10 years on average to build one.

The current global electricity consumption is approximately 23,000 TWh per year, with AI expected to account for a growing share of this demand. However, our existing energy infrastructure — heavily reliant on fossil fuels — is already struggling to meet both current needs and projected increases in demand.

While renewable energy sources like solar, wind, and hydro are rapidly growing, they are not yet at the scale needed to meet the projected rise in energy consumption from AI. Current global renewable capacity is around 3,000 GW for solar, 900 GW for wind, and 1,300 GW for hydro. To meet the additional demands of AI, we would need to significantly ramp up installations across all renewable sectors.

Simply put: AI will necessitate a monumental increase in renewable energy capacity worldwide. This could mark the beginning of a new golden age for renewable energy investments — and that time is now.

A global benchmark of clean energy stocks is outperforming major equity indexes and even gold, as investors respond to soaring demand for renewables needed to power the AI boom. The S&P Global Clean Energy Transition Index has surged nearly 50% since the U.S. President’s April tariff announcements caused havoc across markets. That compares with roughly 35% gains delivered by both the S&P 500 Index and gold over the same period.

Investors have turned more positive on green stocks as it becomes increasingly clear that the energy needed to power AI can’t be delivered without renewables. That’s despite efforts by the Trump administration to roll back green policies, while China, India, Europe, and several U.S. states remain committed to low-carbon sectors.

The rebound has helped money managers attract capital for green funds. On Tuesday, Brookfield Asset Management announced it had raised $20 billion for the world’s largest private fund dedicated to the clean-energy transition. That coincided with an announcement from Resolution Investors LLP that it had launched a global equity climate fund targeting $1 billion within a few years.

Keep reading with a 7-day free trial

Subscribe to ESG on a Sunday to keep reading this post and get 7 days of free access to the full post archives.