Week 6: ESG in Latin America 🌎

In this issue: ▸ The abundant nature – and the exploitation ▸ Corruption and economic inequality ▸ ESG framework, demand, the firms ▸ A poem by Gabriela Mistral ▸ And much more...

Dear all,

We are continuing our “ESG around the world” journey. This week we go deeper into Latin America.

This vast, diverse, resource rich continent encompassing everything from some of the world’s largest jungles, rainforests and rivers as well as deposits of minerals and multitude of ancient cultures.

The abundant nature – and the exploitation

Latin America is a treasure house of natural resources. These include mineral resources, such as gold and silver, as well as energy resources, such as oil and natural gas. In addition, the region is rich in agricultural and forest resources, such as timber.

Brazil, Peru, and Bolivia are major producers of tin. Lead and zinc deposits are found primarily in higher elevations of Peru, Bolivia, southern Brazil, and northern Argentina. Latin America is also home to some deposits of oil and natural gas with Venezuela and Brazil as largest producers.

With little more than 8% of the global population, Latin America has 23% of the potentially arable land, 10% of the cultivated land, 17% of the pastures, 22% of the forests (and 52% of the tropical forests), and 31% of the permanently usable freshwater.

Latin America is both home of the resources and home of deforestation in the Amazon rainforest, palm oil production, Illegal mining. Resource-rich lands and waters across the region are increasingly exploited in the form of logging and ranching by agricultural and mining operations to meet the soaring demand for raw exports like oil and timber in the north.

Sometimes, these activities drive industrialisation onto land without the consent of local communities, who are forced to become advocates for the preservation of their land and their own welfare.

Unfortunately, Latin America is also one of the most dangerous regions in the world for environmental activists. According to Global Witness, 60 percent of killings of the world’s environmental activists last year occurred in Latin America. In Brazil, 50 environmental defenders were killed – the world’s highest death toll.

If you want to find out more about big environmental stories in Latin America have a look here.

And if you want to explore the environmental impact of globalisation on Latin America you can find it here.

Corruption and economic inequality

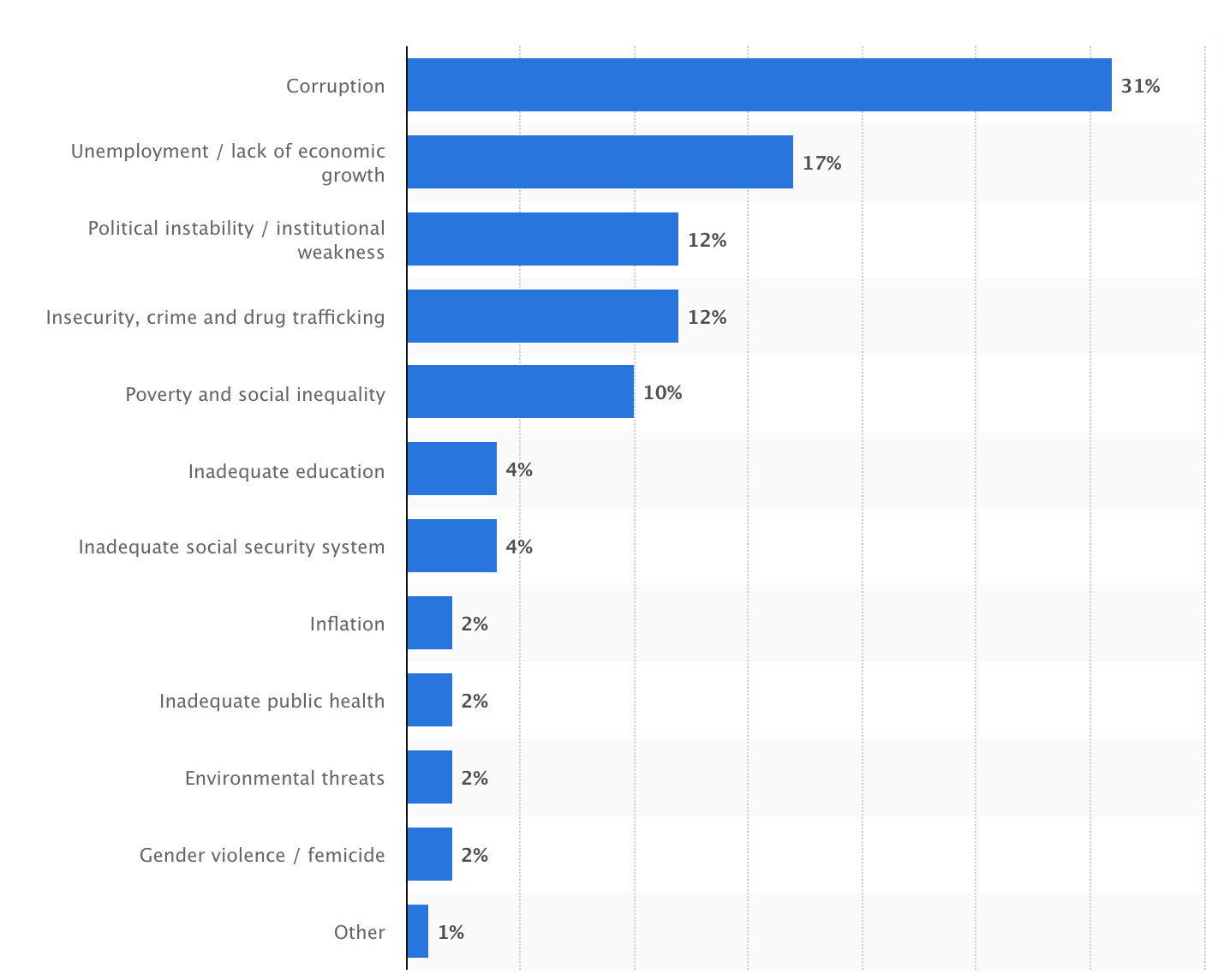

But to keep it on the track, let’s start with some numbers. What are the main issues in Latin America? Well, corruption is number one, followed by economic growth and political instability, you can find it here.

The disparity of wealth in Latin America and the Caribbean is among the largest in the world. In at least ten countries, the richest twenty percent of the population held over half of the country's income as of 2018. Corruption plays a significant role in perpetuating economic inequality across the region at both a geopolitical and local level.

From everyday encounters with the police and civil servants to large-scale governmental scandals – with the Odebrecht laundromat case being one of the most infamous in the past years – corruption is considered one of the most pressing issues in Latin America by a large share of the public and the press.

ESG framework in Latin America

ESG key players In Latin America include a wide variety of entities, such as institutional investors, NGOs, ISS/Glass Lewis, and ESG standard setting bodies.

The International Capital Markets Association (ICMA) has launched the Green Bond Principles, the Social Bond Principles, the Sustainability Bond Guidelines, and as recently as June 2020, the Sustainability-Linked Bond Principles (collectively, ‘the Principles’).

One development in the region is the implementation of disclosure standards and indices spearheaded by local regulators and stock exchanges. For example, past year, Mexico launched the S&P/BMV Total Mexico ESG Index, which uses a rules-based selection criterion based on relevant ESG principles.

However, ESG reporting is still voluntary.

In Argentina, the Buenos Aires Stock Exchange (BYMA) does not require a public company to submit or publish a sustainability report. Instead, in line with international practices, the BYMA has implemented various initiatives to promote good corporate governance and sustainability practices, such as a Sustainability Index with the IDB that serves to highlight leading ESG companies to investors.

Brazil is requiring listed issuers to disclose socio-environmental information in their annual reports. The stated purpose is to encourage issuers to make consistent disclosures on social and environmental issues, and provide the market with comparative information, thereby dependably apprising investors of Brazil’s pertinent ESG information.

Many other countries in the region are developing sustainability standards and are looking to enhance the investment products in the space to further aid in economic development.

But it is worth to mention that while institutional investors in Latin America can already access sustainable investment strategies with exposure to international markets, domestic exposures are largely unavailable – and this is where ESG truly can make a difference.

A strong demand for ESG investing

It would seem that at this point in time, Latin America (and the Caribbean) present a unique market for ESG investments.

The design of public policies in Latin America, especially in the ESG sphere, requires more strategic depth and a long-term perspective. Regulations are often reactive: they are pushed after an emergency. They respond to an agenda, rather than push it.

However, of all the investors in the world, those in Latin America demonstrate the strongest demand for ESG investing. Not only do they see ESG as a way to align their assets with their personal values, but they also see the potential for enhanced investment performance. It seems to offer them the best of both worlds (read more):

Nearly two thirds (63%) say they consider their investments to be a way of making positive social and/or environmental impact.

Another 57% believe their investments can have a positive impact on the world, compared to 47% globally. That’s the highest number in all the regions surveyed.

And 69% say if a fund demonstrated a better carbon footprint than others, they would be more inclined to buy it.

Overall, Latin America is actively creating many opportunities for ESG investment and we can expect that governments and private sector actors will continue to promote ESG investment in the region.

ESG in Latin American companies

How does this impact companies and what is the status in Latin America from ESG point of view? International ESG best practices are being integrated into the region’s corporations, and it’s happening across all industries.

The IndexAmericas, created by the Inter-American Development Bank (IDB), highlights the top 100 sustainable firms operating in Latin America, measured against ESG criteria, as well as on their performance in areas such as gender equality and diversity.

This index has largely been made up of foreign multinationals since its inception, but in the last three years, the number of Latin American firms has increased by almost 30%, demonstrating just how much the issue of corporate sustainability is gaining force in the region.

However, there’s still just 20 companies from the region on the current 2019 list, including 12 from Brazil, two from Chile, and three each from Colombia and Mexico.

Six firms have been in the top 100 each year of the index, including Brazil’s Engie Brasil Energia, Chile Colbun, and Mexico’s América Movil. You can find it here.

A textbook example of the risks in emerging markets

In recent years, Latin American companies have been in the global financial news for one main reason – their involvement in corruption scandals. Blue chip firms such as oil giants Petrobras and Pemex and construction groups such as Odebrecht and Graña y Montero were directly linked to some of the biggest bribery cases that the world has ever seen.

Equity and bond investors, which in the early 2010s gobbled up such securities as they posted stellar rate growths, suffered significant losses as a result.

The woes of companies that have stumbled after scandals in Argentina, Brazil, Colombia, Mexico and Peru constitute a textbook illustration of the risks of investing in emerging markets.

As democratic regimes mature, the old, unsavoury practices of traditional business groups risk being disclosed. This affects their businesses and the value of securities held by international investors. You can read more about it here.

COVID-19 and climate change

Like everywhere else the pandemic is ravaging Latin America, but it also offers an opportunity to transform the region for the better. The financial system can play a significant role in building a sustainable recovery through the use of ESG investments.

The climate crisis, albeit unfolding over a longer time period, has many parallels with the pandemic, and ultimately threatens the region, and the world, with even graver economic and health consequences.

People in the region have shown a keen awareness of that threat, even during the COVID-19 crisis. An online survey conducted by Ipsos in April showed that more 71% of people in 14 countries (in Sweden the number is 60%) agree that climate change is as serious a concern as the pandemic over the long-term, and nearly two-thirds believe it should be prioritised as part of the recovery.

In this piece you can find very good review on core developments.

Now is a time for foresight

History has taught us that in the lives of nations, costly mistakes are sometimes caused by ignorance, sometimes by hubris, and occasionally, by bad luck. But all too often, they are the outcome of a lack of foresight.

In our fast-changing age, foresight is often viewed as a luxury. In ordinary times, elected officials and business leaders are unlikely to take their eyes off these demands to consider long-term risks or trends that could impact their next generation. But these are not ordinary times.

This is an excellent piece by the Atlantic Council on the future scenarios for Latin America.

A poem by Gabriela Mistral

This week we end with a poem: Chilean poet Gabriela Mistral won the Nobel Prize in Literature in 1945, becoming the first Latin American to do so.

Her biographers have highlighted a close friendship she formed with a railway worker as a key episode in her life. His suicide in 1909 apparently marked her life and work. She never married, and loss and solitude became defining themes in her poetry.

“Decálogo del artista” (“The Ten Commandments of the Artist”) is one of her most celebrated poems and outlines her poetic vision of the universe.

———

THE TEN COMMANDMENTS OF THE ARTIST

I.

You shall love beauty, which is the shadow of God over the Universe.

II.

There is no godless art. Although you love not the Creator, you shall bear witness to Him creating His likeness.

III.

You shall create beauty not to excite the senses but to give sustenance to the soul.

IV.

You shall never use beauty as a pretext for luxury and vanity but as a spiritual devotion.

V.

You shall not seek beauty at carnival or fair or offer your work there, for beauty is virginal and is not to be found at carnival or fair.

VI.

Beauty shall rise from your heart in song, and you shall be the first to be purified.

VII.

The beauty you create shall be known as compassion and shall console the hearts of men.

VIII.

You shall bring forth your work as a mother brings forth her child: out of the blood of your heart.

IX.

Beauty shall not be an opiate that puts you to sleep but a strong wine that fires you to action, for if you fail to be a true man or a true woman, you will fail to be an artist.

X.

Each act of creation shall leave you humble, for it is never as great as your dream and always inferior to that most marvellous dream of God which is Nature.

———

That’s all for now. Have a great week!

Best regards, Sasja